Securing funding is one of the most crucial steps in launching and growing a startup. It can be a daunting task, but with the right approach and preparation, you can attract the necessary financial resources to bring your vision to life. Here’s a comprehensive guide to help you navigate the process of securing adequate funding for your startup.

Understand Your Funding Needs

Before seeking funding, it’s essential to have a clear understanding of how much capital you need and how you plan to use it. Create detailed financial projections, including your startup costs, operating expenses, and anticipated revenue. Knowing your financial needs will help you determine the type and amount of funding that’s right for your business.

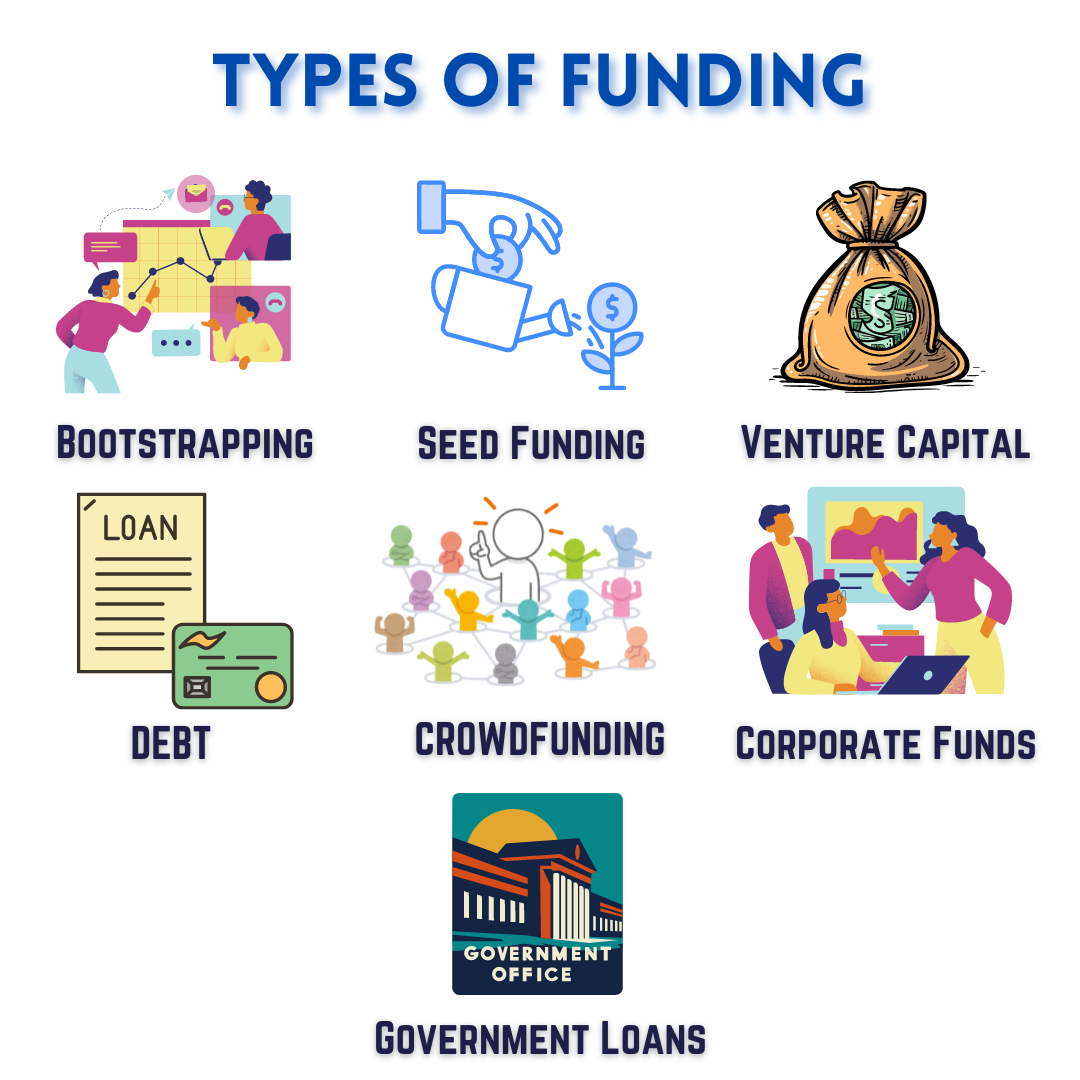

Explore Different Funding Options

There are various funding options available to startups, each with its pros and cons. Understanding these options will help you choose the best fit for your business.

Bootstrapping: Using your own savings or revenue from early sales to fund your business. This approach allows you to retain full control but may limit your growth potential.

Friends and Family: Borrowing money from friends or family members can be a quick and flexible funding source. Ensure clear agreements are in place to avoid potential conflicts.

Angel Investors: Wealthy individuals who provide capital in exchange for equity or convertible debt. They often bring valuable expertise and networks to your startup.

Venture Capital (VC): Professional investment firms that fund high-growth startups in exchange for equity. VCs can provide substantial capital but may require significant ownership and control.

Crowdfunding: Raising small amounts of money from a large number of people, typically through online platforms. Crowdfunding can also serve as a marketing tool to validate your product.

Government Grants and Loans: Various government programs offer grants, loans, or tax incentives to support startups. These can be highly competitive but provide non-dilutive funding.

Incubators and Accelerators: Programs that offer funding, mentorship, and resources in exchange for equity. They can help you refine your business model and accelerate growth.

Prepare a Compelling Pitch

To secure funding, you need to convince potential investors of your startup’s potential. A compelling pitch should include:

Executive Summary: A brief overview of your business, highlighting the problem you’re solving, your solution, target market, and business model.

Problem and Solution: Clearly articulate the problem you’re addressing and how your product or service provides a unique solution.

Market Opportunity: Demonstrate a deep understanding of your target market, including size, growth potential, and trends.

Business Model: Explain how your startup will make money. Include your pricing strategy, revenue streams, and cost structure.

Traction: Highlight any early successes, such as user growth, revenue, partnerships, or customer testimonials.

Team: Showcase your team’s expertise and experience. Investors invest in people as much as in ideas.

Financial Projections: Provide realistic financial forecasts, including revenue, expenses, and profitability over the next 3-5 years.

Funding Request: Specify how much funding you’re seeking, how you’ll use the funds, and the expected impact on your business.

Network and Build Relationships

Building relationships with potential investors is crucial. Attend industry events, pitch competitions, and networking gatherings to connect with investors. Leverage your existing network and seek introductions to potential investors. Building trust and rapport can significantly enhance your chances of securing funding.

Negotiate the Terms

When you receive a funding offer, carefully review the terms and conditions. Key aspects to consider include the amount of equity you’re giving up, control and decision-making power, and any repayment terms if it’s a loan. It’s wise to consult with legal and financial advisors to ensure the terms are fair and aligned with your business goals.

Stay Persistent and Resilient

Securing funding can be a long and challenging process. Rejections are common, but each one is an opportunity to refine your pitch and strategy. Stay persistent, learn from feedback, and keep improving your business model. Resilience and adaptability are key traits of successful entrepreneurs.

Comments (0)